The electronics industry saw the signs of a turnaround in the second half of the year as demand spiked and lead times extended for memory ICs (DRAMs and NAND flash), capacitors, resistors, discrete semiconductors and power components. Longer lead times – and allocations – have plagued buyers throughout 2017 and into 2018. This has led to significant challenges in component availability. Distributors with the most on-hand inventory are typically the winners during periods of component shortages and supply constraints: in 2017 they posted double-digit growth.

In the electronics industry, change happens fast and that is exactly what occurred in 2017. In 2016, the electronic components distribution industry faced declining component demand, supplier consolidation, currency fluctuations and lower margins, resulting in overall negative growth.

Many component manufacturers questioned whether the uptick in demand was real and hesitated to ramp up production capacity. This contributed to additional supply constraints. Despite the scarcity of components, the top franchised distributors increased their revenue by 8 percent in 2017, due in part to higher prices, particularly DRAMs and NAND flash.

North American revenue for the top electronics distributors increased by $2 billion to $27.4 billion in 2017, up from $25.3 billion in 2016. Increased sales also led to a higher head count. Of distributors that provided employee data, 64 percent increased their roster while 21 percent maintained the same number of employees. Only 15 percent cut their workforce.

Passive/electromechanical sales by distributors saw the biggest gains by percentage. Despite supply constraints, extended lead times and allocation for many passive components, the passive/EM segment recorded 10.9 percent growth, reaching nearly $5 billion. This product category accounted for 23 percent of the total NA top distribution sales in 2017, up from 17 percent in 2016. The top 10 passive/EM distributors posted $2.7 billion in sales in 2017, up from $2.2 billion.

Semiconductor sales accounted for 57 percent of the top total NA top distribution sales, up from 46 percent in 2016. Semiconductor sales for the top chip distributors increased by 5 percent in 2017 to $12.7 billion, up from $12.2 billion in 2016. The top 10 chip distributors posted $4.9 billion in chip sales.

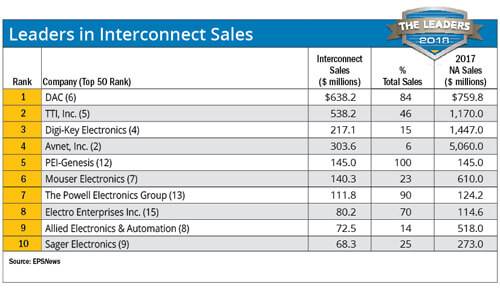

Interconnects accounted for 11 percent of the top distributors’ total revenue to reach $2.5 billion, up 5 percent in 2017. The top 10 interconnect distributors reported $2.2 billion in connector sales, up slightly from $2.1 billion in 2016.

Computer product sales declined in 2017, indicating that fewer distributors are selling these products. Computer-related sales dropped from $6.3 billion in 2016 to $1.5 billion. Avnet’s sale of its Technology Solutions business contributed significantly to the decline: that unit accounted for nearly $3.7 billion of Avnet’s NA business in 2016.

Sales from “other” components dropped for the second year in a row. Sales in that segment declined by 3.5 percent, from $912 million in 2016 to $484 million in 2017. Other components include batteries, power, thermal products, filter components, chemicals, automation & control, test & measurement, and hardware. Component sales are based on responses from 41 distributors.

Overall, North American distributors benefited from strength across most industry sectors, particularly automotive, industrial and enterprise data centers. Thirty-nine of the top NA electronics distributors grew their revenue in 2017, up from 31 distributors in 2016. Of the 39 distributors with positive growth, 20 recorded sales gains in the double digits. This is up from only 9 in 2016. Only 6 of the top distributors posted negative growth, and two reported flat growth.

Two of the largest distributors – Arrow Electronics and Avnet Inc. – reported single-digit growth in 2017, which is a turnaround from negative growth last year. Arrow posted 7.8 percent revenue growth in North America in 2017, after dropping by 2.4 percent in 2016. Avnet also gained some ground in North America in 2017, recording 4.5 percent growth after a 9.6 percent decline in 2016.

Both distributors are acquiring companies outside of the electronics components distribution business as part of their diversification strategy. Arrow acquired eInfochips, a large design and managed services company focused on the IoT, in 2017. eInfochips has 1,500 IoT solution architects, engineers and software development resources worldwide.

Avnet acquired Dragon Innovation, a provider of hardware and manufacturing services, to help customers launch new products more efficiently. Avnet said the acquisition augments its design and supply chain capabilities beyond electronic components to include finished products.

There were no surprises in the top 10 rankings. All 10 distributors maintained their rankings in 2017 – Arrow (No. 1), Avnet (No. 2), Future (No. 3), Digi-Key (No. 4), TTI (No. 5), DAC (No. 6), Mouser (No. 7), Allied Electronics (No. 8) and Sager (No. 9), and Master (No. 10). The top 10 all recorded positive growth in 2017, with 4 posting double-digit revenue gains.

Demand continues to remain strong for “catalog” distributors that specialize in low-volume, high-mix orders. This is particularly true during times of component shortages. Digi-Key and Mouser, which derive close to half of their sales from semiconductors, both posted double-digit gains in 2017. Digi-Key recorded 19.8 percent growth in North America in 2017, after reporting a strong 6.2 percent growth – considering the general lackluster demand – in 2016. Mouser reported a double-digit increase of 15.1 percent growth in 2017, after recording 4.4 percent growth in 2016.

Catalog house Allied reported nearly 2 percent growth in 2017, down from 5.6 percent growth in 2016. The company announced its new trade name – Allied Electronics & Automation – in January 2018 to better reflect its focus on both electronics and automation and control products.

A newcomer to the top distributor listing, Chip 1 Exchange, recorded the highest growth rate in 2017. The hybrid distributor, ranked No. 44 on our list, grew sales by 42.9 percent, from $7 million in 2016 to $10 million in 2017. Chip 1 Exchange derived 70 percent of its sales from semiconductors, and the remainder from interconnects, passive and electromechanical (IP&E) products.

Several other small to midsized distributors experienced high gains in 2017. SMD (No. 23), an IP&E distributor, grew by 30.5 percent; Area-51 ESG (No. 31) posted a 21.4 percent gain; Fedco Electronics (No. 43), a battery specialist, expanded its revenues by 19.8 percent, and Sherburn (No. 38) reported 17.8 percent growth.

Two other IP&E distributors also achieved double-digit sales growth last year. Hughes-Peters (No. 16) increased its sales by 33.2 percent. The company acquired Hammond Electronics (ranked No. 31 in 2016) in September 2017, expanding its reach into the southeast U.S. March (No. 22) grew its revenue by 23.4 percent.

Other acquisitions in 2017 included PUI’s acquisition of Eric Electronics, a regional distributor specializing in valued-added services in Northern California; Sager’s acquisition of Power Sources Unlimited Inc., and TTI’s acquisitions of Symmetry (ranked No. 24 in 2016) and Changnam I.N.T. Ltd. SMD acquired two distributors in 2017 – Components Center (ranked No. 45 in 2016) and Dalis Electronics. RFMW purchased Microwave Marketing Ltd. in the UK.

Only a few distributors reported investments in personnel, offices or warehouses in North America. Cumberland expanded into two new territories. Diverse announced further expansion in Western Canada and Northeast United States. Stevens Engineering increased its facility capacity in Southern California and continued acquiring companies in the Pacific Northwest and Mountain states.

Phoenics increased its presence in the U.S. with additional sales, application engineers, and inside sales personnel. The company also expanded into Asia and EMEA including Israel.

Several distributors expanded globally with new offices and personnel. IBS announced the expansion of existing global offices and the addition of new offices. Component Distributors added more reps in South America. RFMW added new resources in China, India, Europe and Southeast Asia. Richardson announced a global expansion for RF & microwave, power, electric and industrial products. Flame started a European forward stock location and added business development resources and product managers.

Headwinds in 2017

In addition to margin erosion, which continues to plague the distribution industry, distributors faced several other big challenges in 2017. In fact, supplier/manufacturer lead times usurped margin erosion as the biggest headache for the first time in many years. Another big issue was the economy; and capacity constraints, counterfeiting, vendor consolidation, and a lack of qualified staff/talent acquisition were cited as problems. Only a few distributors noted global trade regulations or restrictions as an issue.

In 2017, the top distributors derived 28 percent of their revenues from the industrial sector for the fourth consecutive year. This is followed by the aerospace/military segment (24 percent), automotive (12 percent), telecommunications (9 percent), medical (7 percent), energy (5 percent), computer products (5 percent), and mobile communications (2 percent). The remainder came from “other” markets.

The industrial market continues to fuel distribution growth. Twenty-four distributors said the industrial sector was the biggest growth driver in 2017, although this is down from 29 distributors in 2016.

This is followed by transportation, according to 20 distributors, and aerospace/military, according to 19 distributors. Eighteen respondents expect the medical sector to drive sales growth, while 16 believe the energy sector will drive growth. Other hot spots include communications (12 distributors) and lighting (11 distributors).

New Products, New Markets and Value-Added Offerings Drive Growth

Nearly all the top distributors offer value-added services and when coupled with new production introductions (NPIs) and new market expansion, distributors expect strong growth in 2018. Some distributors report an increased need for design and value-added services, but a lack of qualified employees could be a roadblock.

Thirty-eight survey respondents, up from 37 last year, expect NPIs to be the biggest growth driver in 2018. Distributors also expect new markets (31 respondents) and value-added services (25 respondents) to drive sales this year. Seven respondents believe acquisitions will fuel growth.

In terms of applications, the internet of things (IoT) is expected to be the biggest growth driver among emerging applications, according to 20 respondents. Eight distributors also report that the smart grid/smart meter sector will boost sales this year. Other notable applications cited include robotics, electric vehicles and cloud computing.

For “green” applications, distributors continue to support energy-efficient lighting and renewable energy, although fewer distributors expect renewables to fuel growth in 2018. Twenty distributors expect the lighting segment to lift growth this year, up from 15 distributors last year. Only five distributors expect solar and wind power segments to drive growth, down from seven respondents.

The survey also finds that 39 of the top distributors posted gains last year. Four of the top 10 leaders by growth derived the majority of their sales from IP&E products which contributed to the component sector’s boost in growth and market share. These distributors include Hughes-Peters, SMD, Marsh, and Sherburn.

Value-Added Services

Distributors play an important services role in two areas: traditional value-added services for products that include all types of assemblies, kitting, bar coding and device programming; and supply chain services. Last year, during an extended period of component shortages and long lead times, buyers and designers found out just how important distributors are in ensuring that they get the parts they need on time. Many supply chain services center on inventory management and replenishment programs that include vendor managed inventory , automated inventory management, bonded inventory, scheduled orders, JIT delivery, and consignment.

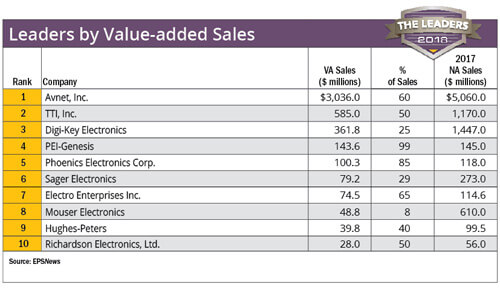

The survey finds that more than half of the top distributors believe value-added services will help them grow their sales in 2018. The survey reveals that 17 distributors derived 50 percent or more of their 2017 sales from value-added services. Six of the top 10 leaders by value-added services earned 50 percent or more of their business from these services.

Ten distributors said 20 percent to 49 percent of their sales are derived from value-added services. The remaining 10 distributors that responded said value-added services accounted for 19 percent or less of their sales.

Value-added sales totaled $4.8 billion or 17.5 percent of distributors’ NA revenues in 2017. This is up from $1.6 billion in 2016, or 5.2 percent of NA revenues. Only 40 of the top distributors responded to the question, and 5 out of the top 10 distributors did not provide the percentage of their sales from value-added services.

Demand for more design help is fueling the distribution industry’s move into services to help customers with complete end solutions. Thirty-two distributors said they offer design services, the same as last year. Those companies employ between 1 and 89 FAEs in North America, and between 1 and 148 designers.

Other services provided by distributors include materials planning, forecast management, counterfeit mitigation, product life cycle management, reverse logistics and electronics asset disposition.

Distributors continue to maintain quality compliance. Of the top distributors, 40 of them have received ISO certification; 1 is in the process of being certified.

Arrow Widens Revenue Gap

Arrow Electronics still holds the top spot for North American sales, widening the revenue gap between the number 2 distributor Avnet. Arrow’s NA sales grew 7.8 percent, reaching $11.3 billion in 2017, up from $10.5 billion in 2016. Global sales grew by 12.5 percent, reaching $26.8 billion, up from $23.8 in 2016. Arrow reported that global components have been at or above the high end of its expectations for six quarters in a row and it achieved record fourth quarter sales in all three regions.

Avnet, ranked at No. 2, reported $5.06 billion in sales in the Americas in 2017, up 4.5 percent from 2016. Avnet global sales increased by 10.9 percent from $16.44 billion in 2016 to $18.23 billion in 2017. Avnet’s CY 2016 sales are now reported on a continuing operations basis, after the sale of its Technology Solutions business in February 2017.

Catalog Distributors Drive Online Sales Growth

Of the top distributors, 25 said they offer online buying. However, several of the largest distributors – Arrow, Avnet, Future, DAC, and TTI – did not provide the percentage of their sales via the internet.

Eight distributors reported double-digit sales via online purchases. These distributors include Allied Electronics, Digi-Key, and Mouser Electronics. These catalog distributors continue to drive a bigger portion of their revenues from online sales, even if it’s only by one or two percentage points per year.

Digi-Key’s online sales hit 89 percent of total sales in 2017. The distributor has consistently increased its revenue from online sales annually from 83 percent in 2011 to 88 percent in 2016.

Allied’s online sales also increased in 2017: online sales rose to 43 percent of total sales up from 42 percent in 2016. Revenues from online orders have ranged between 40 to 41 percent from 2011 to 2015.

Mouser derived 54 percent of its sales from online orders in 2017, up from 53 percent in 2016 and 51 percent in 2015. The distributor increased its online sales from 40 percent to 50 percent from 2011 to 2014.

Many distributor websites now offer buying tools including order status & tracking, order history, online quotes, saved parts list, real-time stock status, cart project sharing, and BOM uploads. Other services include lead time information and life cycle notification.

Other website resources include parametric search, product training videos, live chat, reference designs, online catalogs and other online design tools. These are designed to help buyers and designers select the right components and vendors for their applications and end products.

Global Sales Climb 10% in 2017

Global revenues of the top North American distributors increased by 10 percent in 2017, after dropping by two percent in 2016 and flat sales in 2015. Global revenues rose to $63.8 billion from $57.9 billion in 2016. The top NA distributors derived the majority of their global sales from North America with 49 percent market share in 2017, compared to 47 percent market share in 2016. Component distributors reported robust growth in all regions.

Regional breakdown revenues were based on 44 respondents, down from 48 last year. The top distributors derived $15.7 billion or 31 percent of their sales EMEA (Europe, Middle East, and Africa) in 2017, that’s up from$15.1 billion or 26 percent of their sales in 2016. Sales in Asia decreased from $14.6 billion or 25 percent of sales in 2016, to $9.3 billion or 18 percent of sales in 2017. Distributors still only derive about two percent of sales from South America.

Slightly Higher Sales Needed to Make the Top 50

To earn a spot on the top North American franchised distribution ranking in 2017, distributors needed to post $6.1 million in revenue, up from $5.8 million in revenue. Hybrid distributors also had to meet a specific percentage to be considered. However, this year’s ranking only includes 47 distributors instead of the traditional 50. In 2017, three distributors were knocked off the ranking due to acquisitions. Components Center was acquired by SMD, East Coast Microwave was bought by Powell Electronics, and Hughes-Peters acquired Hammond Electronics. One new distributor, Chip 1 Exchange, joined the ranks of the top distributors.

The more info: Top 50 electronic components distributor in 2018