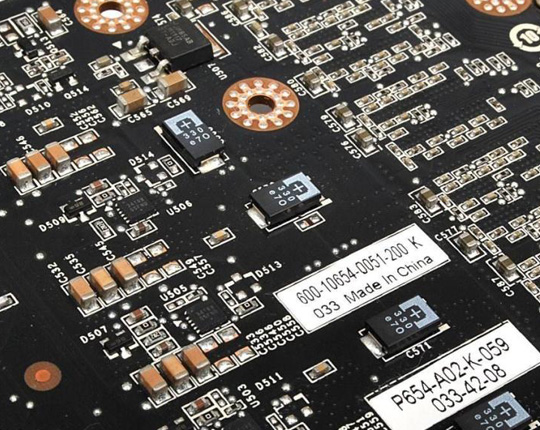

Driven by automotive demand, Japan’s six major electronic component manufacturers Murata, TDK, Kyocera, Nidec, Alps Electric and Nitto Denko continue to grow, in the past three months Sales increased by 7% to approximately 1.69 trillion yen compared with the same period of last year. This is the eighth consecutive quarter of continuous growth. Sales exceeded the 1.48 trillion yen in 2017 Q4, setting a new record for the single season. The report pointed out that the demand for autonomous, electric vehicles (EV) and other vehicles is the main reason for increasing the order value of the six major parts factories in Japan.

In the last quarter, the global MLCC giant Murata orders increased by 10%, and TDK and Kyocera also grew by 10% and 14% respectively. However, due to the maturity of the smart phone market and the adjustment of the stocks of major manufacturers such as Apple and Samsung, the orders of the six major parts factories in Japan were new highs in the previous quarter, but the growth rate has once again shrunk to below 10%, which is a record of the smallest increase in single-season growth since Q4 2016.

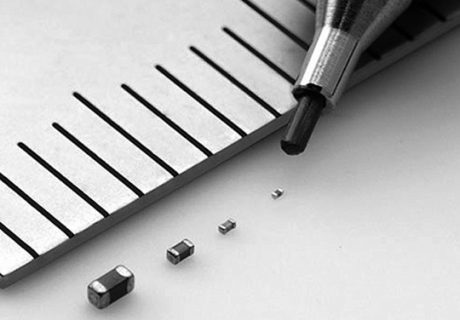

Tsuneo Murata, president and president of Murata Manufacturing Co., said in an interview on October 16 that the MLCC, which is currently in serious shortage of stocks, will continue to be in a tight supply and demand situation for the next two years. Tsuneo Murata pointed out that although the MLCC manufacturers have increased production, it will take about two years for the supply to catch up with the increase in demand.

Murata has expanded its MLCC capacity by 10% per year, and will increase production by the same scale next year. In addition, Kyocera is currently constructing a new MLCC plant and is expected to start production by the end of March 2019.