An unprecedented shortage has paralyzed the electronics industry this year, with demand far outstripping supply. The shortages have been extensive – resistors and capacitors, transistors and diodes and a wide range of ICs have all been affected. It’s no wonder since our lives are becoming increasingly driven by technology, from the cars we drive to the mobile devices to which we’re constantly attached.

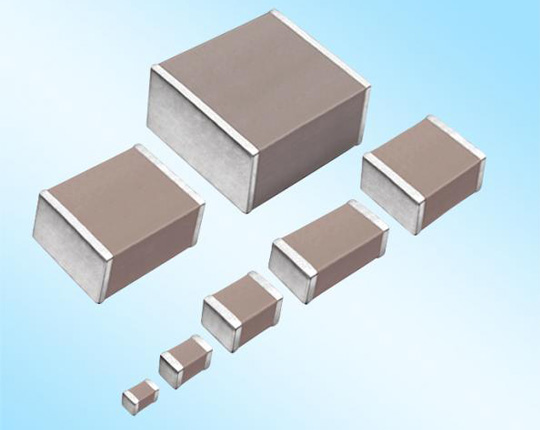

The shortages on MLCC have been raising the most concern. According to many in the industry, it’s the largest and longest MLCC shortage in history, largely driven by automotive, smartphone, big data and IoT demand. Some predictions even point to issues lasting well into 2020. As the shortage pushes past the one-year mark, the expectation among suppliers and end customers is that the situation will get worse before it gets better. The confluence of the strong global economy driving demand and the ever-expanding adoption of electronics across a multiplicity of industries and product types continues to strain MLCC production capacities.

Some suppliers have reported seeing more than 20 percent of MLCC lead times extend for 6 months or more and as a result, manufacturers are raising prices by as much as 40-50 percent.

But MLCCs are not alone. MOSFET supply will continue to be tight next year, mainly due to increased demand in new applications and insufficient supply of wafer. Thick film chip resistors remain active due to raw material shortages and increased demand. September brought about drastic increases in PC CPU pricing as well, with some models trading at 35-40 percent higher than they did in August

One sign of relief, however, is that a sustained shortage of memory products tracing back to the summer of 2016 has finally given way to oversupply in the market with some DRAM and NAND market pricing even dropping below contract pricing.