ON edged Wall Street’s targets for the second quarter and guided slightly higher than views for the current quarter, but the chipmaker’s shares dipped on Monday. The Phoenix-based company late Sunday said it earned an adjusted 46 cents a share on sales of $1.46 billion in the June quarter. Analysts expected ON Semiconductor to earn 45 cents a share on sales of $1.43 billion. On a year-over-year basis, the company’s earnings per share rose 28% while sales climbed 9%.

For the current quarter, ON Semi predicted sales of $1.51 billion, vs. the consensus estimate of $1.48 billion. Its guidance implied earnings per share of 50 cents, vs. the consensus estimate of 48 cents.

ON Semi stock slid 3.4% to close at 22.36 on the stock market today. The stock has been consolidating for the past eight weeks with a buy point of 26.48.

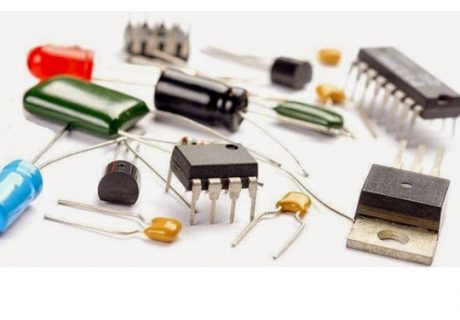

ON Semiconductor makes chips for power management, analog, logic, timing, connectivity and other functions. Its products are used for automotive, communications, computing, consumer, industrial, medical, aerospace and defense applications.

Better-than-expected sales of chips for consumer and communications devices drove the company’s second-quarter beat, analysts said.

ON Semiconductor Called ‘Top Pick’

“With improving cost synergies, auto and industrial at 59% of revenues and solid free cash flow, ON remains a top pick,” Mizuho Securities analyst Vijay Rakesh said in a report. He reiterated his buy rating with a price target of 27.

Susquehanna Financial Group analyst Christopher Rolland also gave thumbs up to ON Semi’s report.

“While we worry a bit about cycle risks, ON is managing fairly well and new auto/industrial opportunities abound,” Rolland said in a report Monday. He rates ON Semi stock as positive with a price target of 28.

ON Semiconductor Chief Executive Keith Jackson said he is “increasingly upbeat” about the company’s long-term prospects.

“Demand for our products continues to accelerate as customers are increasingly relying on us to provide key technologies for newly emerging applications in automotive and industrial markets,” he said in a news release. “With a pipeline of new products and strengthening customer engagement, we are well-positioned to benefit from disruptive trends in our markets.”