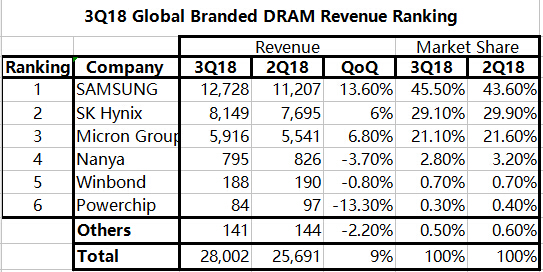

SK Hynix and Samsung account for 75% of the global memory chip market share and may continue to climb. By the third quarter of this year, Korean companies produced DRAM chips that accounted for 75% of the global market, with Samsung and SK Hynix occupying an important position.

According to data released by DRAMeXchange, as of September this year, Samsung and SK Hynix have reached 74.6% of the DRAM market, of which Samsung accounted for 45.5%, SK Hynix accounted for 29.1%, and Micron accounted for 21.1%.

On November 15 this year, SK hynix released the first JEDEC-compliant DDRS DRAM, while Samsung successfully developed the lOnm-level LPDDRS DRAM in July, further ahead of the world in technology. According to earlier reports, SK hynix’s DDRS DRAM has reduced power consumption by 30% compared to DDR4, and data transmission speed is also 60% faster. It is suitable for applications such as big data and Al computing, further opening up the market and sales.

The top DRAM suppliers also took their operating margins to new record highs in 3Q18. Although the increases in their ASPs moderated during the period, they were able to raise their operating margins from the previous quarter by optimizing their cost structures via the use of the more advanced manufacturing technologies. Samsung’s increase was the smallest among the top three because of the low yield rate of its 1Y-nm process that was just deployed in the same quarter. Still, Samsung achieved a new record by a nudge of one percentage point from 69% in 2Q18 to 70% in 3Q18. This result also means that Samsung’s gross margin already surpassed the 80% threshold.

SK Hynix raised its operating margin from 63% in 2Q18 to 66% in 3Q18, as it has effectively boosted the yield rate of its 1X-nm process. SK Hynix’s increase was also the largest among the top three. As for Micron, its operating margin came to 62% in 3Q18, up from 60% in 2Q18. The improvement in Micron’s profitability was attributed to the increase in the output share of its 1X-nm process. Looking ahead to 4Q18, the top suppliers are not expected to make new records since their cost reduction efforts will unlikely be enough to offset the effect of plummeting prices.

In the global market, China is currently the largest consumer of semiconductor chips, consuming more than one-third of the world’s semiconductor chips, and DRAM memory and NAND flash chips are almost all imported. Micron has been investigated and banned due to patent issues with Jinhua and U MC, which will have an impact on Micron’s market share. In this context, the market share of Samsung and SK Hynix is likely to continue to climb.