Due to the shortage of MLCC in the past two years, the second-tier manufacturers of passive components have expanded capacity, but in the second half of this year, among the second-tier producers, there will be no new capacity except Darfon Electronics.

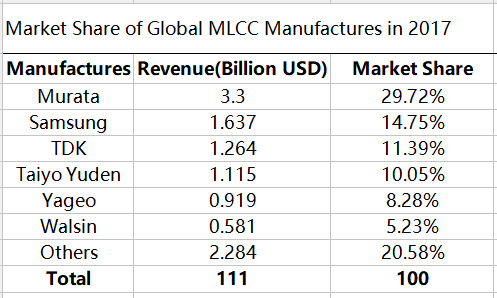

According to the market report, including Kemet, Vishay, HolyStone, Darfon Electronics, Prosperity Dielectrics Co., Ltd., FH Advanced Technoloy, Eyang, CCTC and other more than 10 manufacturers, the total market share is about 20%. The market share of the top six manufacturers is as high as 80%.

Market Share Analysis:

The manufacturers of capacitors that have demonstrated the largest amount of growth between 1993 and 2018 have been manufacturers of high capacitance MLCC, or manufacturers who have yoked together multiple dielectrics through acquisition. However the strategy of investing in increasing capacitance in small case size packages was very successful for MLCC manufacturers in Japan , Korea and Taiwan China. It is highly unlikely that manufacturers of high capacitance BME MLCC will materialize from any of the specialty ceramic chip capacitor manufacturers, rather we expect that in specific areas of precious metal based MLCC that have been directed toward auto will have to convert to nickel in small batch processes. This is also a unique market opportunity materializing in the USA, Germany, France and Korea today.

HolyStone’s MLCC capacity is maintained at 8 to 1 billion units per month, most of the new production capacity of HolyStone has been released in the second quarter, the third quarter can only increase production capacity slightly through equipment adjustment. According to HolyStone, the next new capacity may have to wait until 2019.

FH Advanced Technology, the largest passive component manufacturer in mainland China, revealed that it will complete its monthly 5.6 billion MLCC expansion plan in the fourth quarter of next year. The company did not disclose its capacity target at the end of this year. However, according to industry insiders, the target of FH Advanced is only about 15 billion. According to this value, the global market share is less than 3%.

In terms of first-tier manufacturers, according to the report, Murata and Taiyo have increased production by 10% this year, and Samsung increased production by about 20%. However, these three giants are mainly focused on automotive electronics and up to one-third of Samsung’s capacity will be used by itself. Due to the large size of the MLCC for the vehicle, the high precision requirements, and the proportion of raw materials consumed and occupied capacity are also high. In the production of MLCC for vehicles, there may even be a contradiction in which the production capacity is increased and the output is reduced.

Related News:

Walsin predicts that MLCC shortage will remain until 2020

The Changes in Industry Trends Behind The MLCC Shortage

Yageo: Only 1/3 of the Customer‘s MLCC Demands Can Be Supplied Currently

More manufacturers are joining the MLCC market, MLCC shortage tends to ease