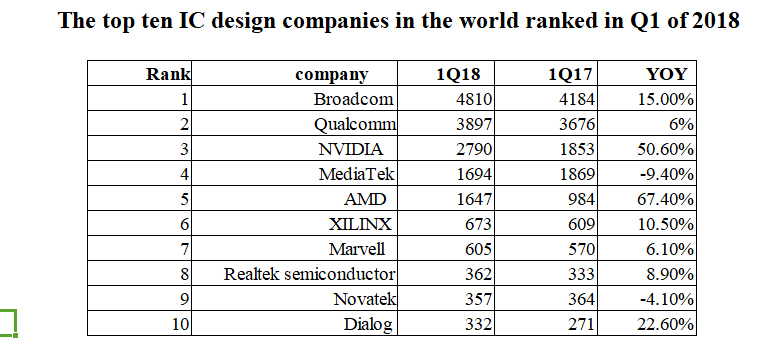

The global top 10 IC design companies in 2018 the first quarter according to revenue and ranking come out, except MediaTek (MediaTek) and Novatek’s revenue presenting recession, the rest 8 manufacturers are going up. Among them, Broadcom topped the list with $48.1 billion, year-on-year growth of 15%. Qualcomm and NVIDIA were second and third with $3.897 billion and $2.79 billion respectively. According to latest statistics of TrendForce’s TOPLOGY RESEARCH INSTITUTE.

Then followed by Mediatek ($1.694 billion), AMD ($1.647 billion), XILINX($673 million), Marvell ($605 million), Realtek semiconductor ($362 million), Novatek ($357 million) and the Dialog ($332 million).

Both Qualcomm and MediaTek’s poor performance in the first quarter.

As for the market’s the most popular qualcomm and mediatek, toplogy research institute’s Yao Jiayang,the industry institute analyst pointed out that since the end of 2017, due to the new phones’ sales less than expected and the impact of rising channel inventory, the the traditional off-season early check-in in first quarter. All big mobile phone manufacturers for 2018 market relatively keeps conservative attitude, which knock-on effects on two mobile phone chips factory orders for the first quarter of this year.

Even if Qualcomm well performed with $3.897 billion in the first quarter this year but compared with the second quarter of 2017 began with a record of more than $4 billion for three consecutive quarters, Qualcomm’s performance is obviously not very excellent.

In the first quarter this year, MediaTek did not perform well, and revenue has been declining for four consecutive seasons, but its gross profit margin has gradually stabilized in the last three quarters.Like in the first quarter gross margin reached 38.4%, partly because the 12 nm technology adopted in P60 processor, has the market competitive advantage, coupled with the big factories like OPPO back with adoping P60 to launch a new generation and high-end phone models. Although the stock is limited at beginning, it is still useful for lifting the overall gross profit margin.However, since P60 was released in the first quarter this year, it should be possible to check the earnings in the second quarter if it aims to bring significant revenue contribution to MediaTek.

As for the development of the two firms in the second quarter, Yao Jiayang argues that due to the new generation qualcomm Xiao dragon series 700 processor still no further news, it could affect the development of high-end model phones of main mobile phone companies this year. If Media Tek strengthens P60 active layout on client side, and technical support to the key customers without effecting the gross profit margin, Qualcomm’s second-quarter financial statement is likely to be slightly dented.

AMD and NVIDIA in the global mining boom.

In the top 10, the best performers were AMD and NVIDIA, with revenues up 67.4 per cent and 50.6 per cent in the first quarter.

According to yao, the reason for AMD’s performance is that the growth momentum of the operation and drawing business group is quite strong, and its YoY is 88.0%, which leads to the overall revenue growth.Further analysis towards the root reasons, mainly is the performance of CHLWEE in the same period last year was not very satisfactory .Second, due to the global mining demand is still hot recently, the demand for a new generation of graphics chipshigh with computing performance is rising which make the CHLWEE not only show its growth performance in first quarter, but also obtain the Net profit higher than recent four years, reaching 8100 dollars.

NVIDIA has maintained a high level of growth.Mr Yao points out that NVIDIA is mainly benefiting from the game and server market. Revenue in the game area reached $1.728 billion, while the server was $669 million, 52.4% year-on-year growth and 80.3%year-on-year growth respectively.

It is worth mentioning that NVIDIA latest quarterly financial statement shows that, in the OEM business there is an income of $289 million from the virtual currency, which demonstrates that GPU makers really benefit a lot from the global mining boom.

Looking ahead to the world’s top 10 IC designers’ earnings for the second quarter of 2018, yao said there will be no chane in the top five, but the rank from the sixth to 10th maybe change. It is worth noting that since the acquisition of Cavium has been determined by Marvell, it will further improve the domain schemes integrity of the netcom and server .Cavium has been in the range of $2 billion to $2.5 billion a quarter since the fourth quarter of 2016. In the second quarter this year, Marvell will have the chance to surpass Xilinx to take the sixth place, if it is booked into the revenue of Cavium.