TSMC announced that it has approved a $3.36 billion for new fab facility construction, and advanced-node and specialty technology upgrades and related capacity expansions.

TSMC pointed out that the capital budget will be used to build factories, expand and upgrade advanced process capacity, upgrade special process capacity, convert logic process capacity to special process capacity, and develop capital budget and recurring capital budget in the first quarter of next year. The board also approved another appropriation of approximately US$17.32 million for capitalized leased assets in the first half of 2019.

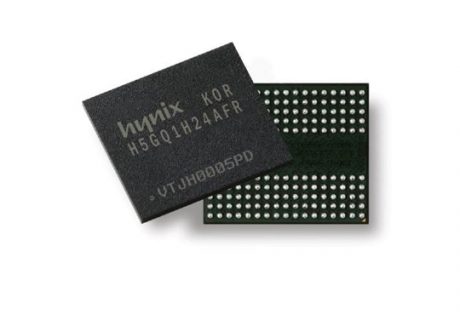

It is worth noting that IC Insights announced today that the top 15 semiconductor suppliers this year, TSMC was surpassed by SK hynix, ranking from the third place last year to the fourth place.

Samsung’s sales will increase by more than 25% annually among the top 15 semiconductor suppliers in the world this year; SK Hynix’s annual growth rate is the highest among all manufacturers, with an annual growth rate of 41%; TSMC’s annual growth rate is 6%, which is lagging behind other manufacturers in terms of growth.

TSMC’s board of directors today approved the appointment of Xilinx’s former CEO Moshe N. Gavrielov as a member of the remuneration committee, which is effective today. TSMC said that it mainly hopes to enhance the independence of the remuneration committee.

TSMC’s technology leadership is driving its average revenue per wafer. According to IC Insights. TSMC’s average revenue per wafer in 2018 is forecast to be US$1,382, which is 36% higher than Globalfoundries’ US$1,014, and 93% above UMC’s US$715.

TSMC will be the only pure-play foundry among the world’s top-15 semiconductor sales leaders in 2018, IC Insights said in a separate report. TSMC is forecast to be the fourth-largest semiconductor company in the world this year, trailing Samsung, Intel and SK Hynix.