Artificial intelligence is the hottest technology these years.

China’s use of facial recognition technology for widespread state surveillance has been feverishly reported by many media in recent months. The latest is the UK’s Financial Times, which reminds us of a 2015 official paper that articulated a vision to have a national video surveillance network by 2020 that is omnipresent, always working and fully controllable.

The technology upon which it is based is reflected in the figures for investments in artificial intelligence (AI) and related tech companies, including semiconductor companies.

Take for example Beijing-based SenseTime, which in the second quarter raised more than $1.2 billion. Among other things, it provides AI-powered surveillance for the Chinese police. This week, it is reported that the SoftBank Vision Fund is considering putting in almost$1 billion more in SenseTime, which is already valued at over $4.5 billion, arguably the most valuable AI company globally.

SenseTime’s two rounds of funding were among 20 semiconductor industry deals raising nearly $1.7 billion in total in the second quarter, according to the newly released GSA Market Watch report. The $1.7 billion represents six times the amount raised in the first quarter and more than 13 times the amount in the second quarter of last year, with the vast majority of the funding going to AI chip companies.

The report also highlights merger and acquisition activity in the second quarter, which saw 12 company acquisitions and three deals involving a semiconductor division. Acquisitions included Himax Technologies buying Israeli vision sensor developer Emza Visual Sense, and Alibaba Group acquiring IC design house Hangzhou C-Sky Microsystems Corp. Ltd.

China AI Driving Need for Home-Grown Semiconductor Talent

A report released by Tsinghua University this month on China’s AI development said China’s investment in AI accounts for nearly 60 percent of the world’s total, measuring the period from 2013 to the first quarter of 2018. While the money might be flowing, the high-level talent is still in short supply.

According to the report, China’s AI market was worth about $3.5 billion in 2017, with computer vision, voice and natural language processing accounting for a large share of this. It expects the market to grow 75 percent in 2018.

In terms of talent, China had an AI talent pool of 18,232 people in 2017, accounting for 8.9 percent of the world’s total, compared to the 13.9 percent share held by the U.S. China also leads over the U.S. and Japan on quantity and citation of research papers and holds the most AI patents, according to the report.

Beijing is the top city attracting AI investment, with 250 billion yuan (about $36.7 billion) raised in more 450 deals from 2015 to the end of the first quarter of this year, followed by Shanghai with 50 billion yuan raised (about $7.3 billion), according to the report.

The rise of China’s tech and alleged stealing of intellectual property and technology are often cited as reasons for the trade war by the U.S. However, experts think that that any trade war will have limited impact. According to the Global Times in China, the U.S. moves might have a short-term impact on China’s technology industry, but it will force China to improve talent development and research. Industry consultant Xiang Yang told the paper, “China’s development on AI is self-reliant. For instance, on chips used for AI technology, Chinese enterprises can provide a stable supply.”

Wayne Shiong, a partner with China Growth Capital, one of the investors in DeePhi Tech, recently acquired by Xilinx, said in a press statement last week that the Chinese government has been encouraging private capital to enter the chip industry, but it’s not been enough. He said that the future development of the semiconductor industry in the country still relies on the generous preferential policies on tax subsidies and talent introduction.

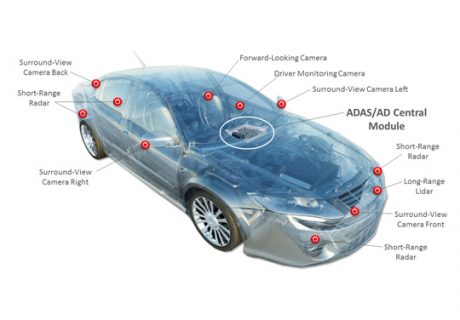

Shiong sees the growth in AI as being a key driver for semiconductor technology in China. Since AI applications necessitate the simultaneous development of basic hardware, this creates opportunities for the chip industry. China’s new development in AI in the areas of security, image analysis, transport management and electronic vehicles puts more pressure on core technology developments in the chip and semiconductor industry. Shiong

“We are already leading the world at the application level, now we need to make up in the core technology level,” Shiong said.