Xilinx purchased DeePhi, a 200-person startup in Beijing, in a deal that shows the speed and global scale of the super-hot AI market. Analysts said that the move was likely an effort to grab hard-to-find deep-learning talent already developing neural-networking software for Xilinx FPGAs.

The deal is not alone in showing how a fast-moving industry is outpacing government concerns about the ownership of technologies such as AI that both China and the U.S. have identified as critical.

Founded by a group from Tsinghua and Stanford Universities, DeePhi has expertise in “deep compression, pruning, and system-level optimization for neural networks,” according to a press statement from Xilinx, one of the company’s Series A investors, in early 2017.

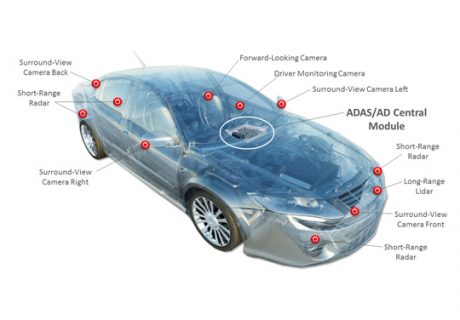

DeePhi’s website claims that the company, founded in 2016, already has developed two hardware architectures. Its Aristotle runs convolutional neural nets for video and imaging recognition while its Descartes supports recurrent and other neural nets for speech recognition and runs on Xilinx FPGAs.

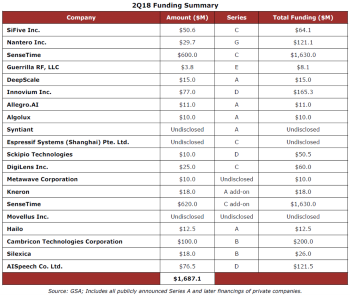

The company is rumored to be the source of deep-learning acceleration in Samsung’s Exynos 9810 in the Galaxy S9 smartphone. Samsung is one of 10 backers that invested a total of more than $40 million in DeePhi last year. Other investors include Mediatek and seven mainly China-based venture capital groups.

Although still early in its life, the startup was said to be seeking an exit amid many acquisition offers. “In today’s market, it is very hard to hire good machine-learning talent, so often the best alternative is to buy startups,” said Kevin Krewell, an analyst with Tirias Research.

“This is an excellent move by Xilinx,” said Chris Rowen, a serial entrepreneur who met recently with DeePhi CEO Song Yao, who finished his undergrad degree at Tsinghua in 2015. “DeePhi has one of the best embedded neural-network teams in the industry — not just in China. This should help Xilinx solidify a spot at the grown-ups’ table for AI.”

Another DeePhi co-founder was cited as a young innovator and recently spoke in a panel at DAC.

Among its areas of expertise, Rowen cited the startup’s “real mastery of the concept of model compression in which trained models are transformed to smaller, denser models without loss of accuracy. They have widely accessible tools and hundreds, if not thousands, of users mapping networks through those tools.” He noted that the techniques improve computer throughput and energy efficiency and reduce memory requirements.

Xilinx’s chief rival got an early lead in AI. The former Altera, now part of Intel, was tapped by Microsoft for a research program on data center accelerators that now has the web giant putting an FPGA on every new server that it buys and expanding its range of FPGA-based services.

Xilinx declined to release financial terms of the acquisition but indicated that it aims to continue investing in the Beijing group.

“Talent and innovation are core to realizing our vision,” said Salil Raje, executive vice president of Xilinx’s software and IP products group, in the company’s press statement. “Xilinx will continue to invest in DeePhi to advance our shared goal of deploying accelerated machine-learning applications in the cloud as well as at the edge.”