Intel and Texas Instrumentsare both mature chipmakers with wide moats. Intel is the largest maker of x86 CPUs for PCs and servers in the world, and TI produces analog and embedded chips for connected cars, industrial IoT machines, consumer electronics, and other devices.

Both stocks easily outperformed the Philadelphia Semiconductor Index’s 23% gain over the past 12 months. Intel’s stock rallied more than 50% as robust demand for its data center chips helped it beat analyst expectations for four straight quarters. TI’s stock, meanwhile, climbed about 40% as strong sales of chips into the auto and industrial markets helped it top expectations for ten consecutive quarters.

However, both chipmakers recently stunned investors with the abrupt resignations of their CEOs. In late June, Brian Krzanich, who led Intel for the past five years, resigned over an inappropriate relationship with an employee. Brian Crutcher, who had just taken over the CEO role at TI in June, resigned due to “violations of the company’s code of conduct” which weren’t related to TI’s “strategy, operations or financial reporting.”

Intel is still searching for a permanent CEO. TI is arguably in better hands, with former CEO Rich Templeton — who led the company for 14 years — taking on the role. But looking beyond these executive shifts, is Intel or TI a better buy at current prices?

Comparing Intel and TI’s core businesses

Over half of Intel’s revenue came from its “PC-centric” x86 chips last year. Another 30% came from its Data Center Group (DCG), which sells its flagship Xeon CPUs to enterprise customers. Intel traditionally dominates the PC and data center markets, but it’s been struggling against a resurgent AMD over the past year.

The rest of Intel’s revenue comes from three higher-growth businesses: its Internet of Things (IoT) chips, non-volatile memory chips, and programmable solutions chips. Intel bundles many of these chips with its data center CPUs, so all three categories are reported alongside its DCG unit under its “data-centric” revenues.

TI breaks down its business into three segments: analog, embedded, and other chips. Analog chips accounted for two-thirds of its revenue last year, while embedded and other chips accounted for 23% and 10% of its revenues, respectively.

Orders from Apple accounted for 11% of TI’s revenues back in 2015. But over the past two years, TI diversified away from Apple, and no single customer accounted for over 10% of its sales in 2016 or 2017.

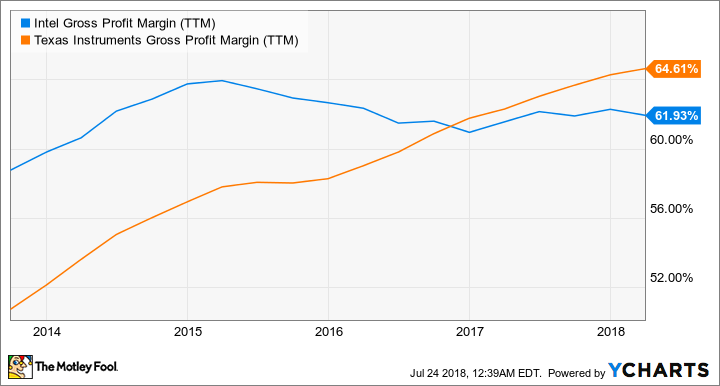

It’s cheaper to produce TI’s analog and embedded chips than Intel’s high-end application processors. Moreover, TI shifted its production from 200mm to 300mm wafers in recent years, which cut its average production costs by around 40%. That’s why TI’s gross margin is now higher than Intel’s.

Which chipmaker is growing faster?

Intel’s revenue rose 6% last year, with its PC-centric revenues rising 3% and its cata-centric revenues growing 16%. Its GAAP earnings slipped 6%, partly due to tax reform expenses in the fourth quarter, but its non-GAAP earnings rose 28%.

Wall Street expects Intel’s revenue and non-GAAP earnings to grow 9% and 16%, respectively, this year. Key catalysts include the gradual rollout of its long-delayed 10nm Cannon Lake chips and sales of new Xeon Phi CPUs optimized for machine learning tasks in data centers. Its non-PC and non-data center revenues are also expected to rise on stronger demand for IoT and computer vision chips, particularly among automakers.

TI’s revenue rose 12% last year as its double-digit sales growth in the analog and embedded segments offset a slight decline in its “other” chips. Its diluted EPS rose 4%. Analysts expect TI’s revenue and earnings to grow 7% and 26%, respectively, this year.

TI’s top line growth should be supported by strong chip demand for the auto and industrial sectors, as well as content share gains in new smartphones. Its bottom line growth should be buoyed by higher margins and bigger buybacks.